KONTRAPRODUKTIVNOST AMERIŠKIH TEHNOLOŠKIH SANKCIJ PROTIV KITAJSKI

Avtor: Jože P. Damijan

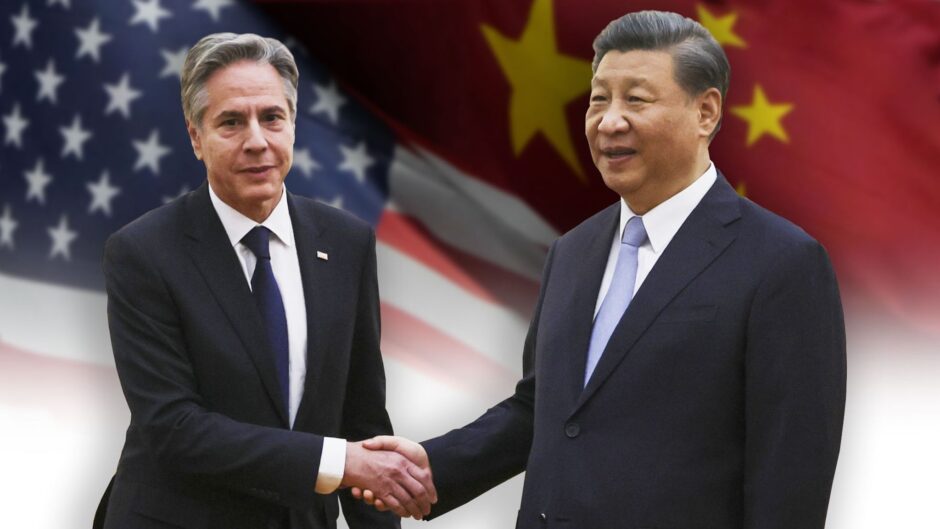

Foto: Sky News

O kontraproduktivnosti ameriških tehnoloških sankcij proti Kitajski sem že precejkrat pisal. Huawei in razvoj 7 nm in 5 nm čipov in litografije za njuno proizvodnjo so najboljša ilustracija tega, kako so prepovedi dobav čipov Huaweiju in prepoved izvoza tehnologije za proizvodnjo čipov (ASML) zgolj spodbudile razvoj čipov in tehnologije za proizvodnjo čipov na Kitajskem, do česar brez ameriških sankcij ne bi prišlo.

No, zdaj so raziskovalci New York Federal Reserve s posebno analizo še dodatno pokazali, kako kontraproduktivne so bile ameriške prepovedi tehnološkega izvoza v Kitajsko. Ugotovili so, da so ameriške izvozne kontrole povzročile razbitje dobaviteljskih verig s Kitajsko, kar je šlo predvsem na škodo ameriških podjetij. Ameriška podjetja teh povezav niso uspela nadomestiti, niti ni znakov, da bi prišlo do oblikovanja novih, krajših in “prijateljskih”, dobaviteljskih verig. Prizadeta ameriška podjetja so zaradi tega doživela padec borznih kotacij za 2.5 % in padec tržnw kapitalizacije za 140 milijard $. Prav tako so se zmanjšali njihovi prihodki in dobičkonosnost.

Na drugi strani pa so na podlagi strateškega obnašanja kitajske države in podjetij kitajska podjetja močno povečala vlaganja v raziskave in razvoj in nove tehnologije, s čimer so postala bolj samozadostna in neodvisna od ameriške tehnologije. Dolgoročno pa to lahko pomeni izrivanje ameriških podjetij na tretjih trgih.

Kratek povzetek:

By forbidding U.S. firms to export to a selected list of Chinese firms for national security reasons, export controls aim to generate a selective decoupling of U.S. firms from China. We indeed show that they prompt a supply chain reconfiguration away from Chinese customers, both those targeted by export controls and those that are not.

This broad-based decoupling of U.S. firms from China is not offset by the creation of new supply chain relations in other countries. Indeed, the total number of customers declines, potentially inflicting collateral damage upon the same U.S. firms whose technology export controls are trying to protect.

However, we find no evidence of reshoring or friend-shoring.

We indeed find that export controls impose significant collateral damage on the affected U.S. firms. We estimate a negative cumulative abnormal return of 2.5% and a decline in revenues and profitability following the introduction of Chinese customers in the export control lists.

These costs ought to be weighed against the expected benefits of such measures. Moreover, the benefits of U.S. export controls, namely denying China access to advanced technology, may be limited as a result of Chinese strategic behavior. Indeed, there is evidence that, following U.S. export controls, China has boosted domestic innovation and self-reliance, and increased purchases from non-U.S. firms that produce similar technology to the U.S.-made ones subject to export controls.

We lack a comprehensive framework to assess the optimality of these geopolitical tools. If national security is a public good, are these export controls a way to make firms internalize their negative externalities? Is it actually beneficial to penalize the same domestic firms that produce cutting-edge technologies? Some may argue that if the government forbids U.S. firms from exporting to certain foreign customers, it should indemnify those U.S. firms. This could be achieved by boosting domestic demand for the restricted goods, in what may look like an industrial plan to reshore or friend-shore high-tech supply chains. In addition, export controls imposed by a single country, the U.S., may not have the desired effect since Chinese firms can potentially buy similar goods from non-U.S. firms. The benefits of U.S. export controls may also be diminished if they trigger an increase in domestic Chinese innovation or in IP theft.

Vir: Crosignani, Matteo, Lina Han, Marco Macchiavelli, and André F. Silva. 2024. “Geopolitical Risk and Decoupling: Evidence from U.S. Export Controls.” Federal Reserve Bank of New York Staff Reports, no. 1096, April. https://doi.org/10.59576/sr.1096